Premier Benefit Indexed Universal Life (IUL)

Welcome Thompson Thrift team to your life insurance with long-term care benefit open enrollment! Long-term care (LTC) may become necessary at any time following a traumatic event, such as a motorcycle accident, or due to a serious illness or cognitive impairment, such as Alzheimer's disease. With a simple application process, you can protect yourself and your family with life insurance and a long-term care benefit. Enrollment is open through February 21, 2025.

Real-Life Stories

What's Special About This Plan?

Enrollment is open through February 21, 2025.

As an employee of Thompson Thrift, you can enroll in this Premier Benefit IUL with a living benefit that can be used for long-term care to help protect you and your family's future.

- Long-Term Care and Life Insurance coverage in one policy

- Cost-effective permanent life insurance coverage - choose 1x, 3x, or 5x your annual salary as a benefit amount

- Easy application process with no medical exams or labs

- May extend coverage to spouse/domestic partner

- Take coverage with you at the same cost should you leave your employer

- Rewards and premium savings through John Hancock Vitality PLUS for the everyday things you do to live a longer, healthier, better life

CALCULATE YOUR LTCI COST vs. BENEFIT

Disclaimer: This calculator assumes 50% of Life Pay premiums allocated to S&P500 and 50% allocated to Fixed account. It is meant to inform and educate on the potential benefits based on the parameters selected. Shown premium rates are estimated based on proportion to selected Benefit amount. Please refer to the contract for final rates and underwriting eligibility. This is not an offer of coverage

Impact

53 million people in the United States are providing unpaid care for a loved one.

COST

The national average cost for an in-home health aide is $6,292 a month.

Funding

Medicare, health insurance, or disability insurance do not cover LTC expenses.

Why do you need long-term care coverage?

Long-term care (LTC) may become necessary following a traumatic event, such as a motorcycle accident, or due to a serious illness or cognitive impairment, such as Alzheimer's disease. In these situations, individuals may require ongoing assistance with ADLs to maintain their quality of life and independence to the greatest extent possible.

How does it work?

Premier Benefit IUL with a long-term care benefit is two-in-one coverage that offers permanent life insurance for family needs plus long-term care benefits for you.

As an employee of Thompson Thrift, this special enrollment period means you can apply for this important coverage with no medical exams or labs. Just answer a few health questions.

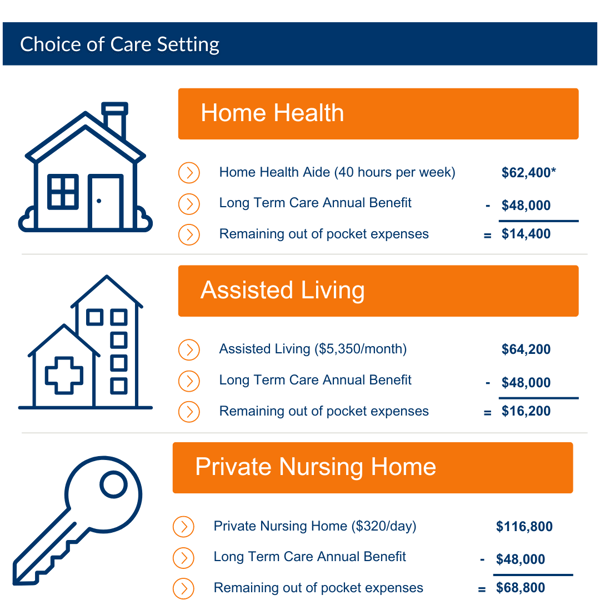

Here are examples of how the long-term care benefit could assist with the soaring costs of long-term care. The illustrations below assume a $4,000/month benefit with care costs reflecting the national median. Policy benefits will vary. Refer to the policy for details.

Also, don't forget to factor in the future cost of care average increase of 4% or more annually.

Top Benefits

Financial Protection

With a simple application process, enroll in coverage that is two benefits in one: permanent indexed universal life insurance and a living benefit that can be used for long-term care.

Portable Benefit

You're able to take these benefits with you if you change jobs from one employer to another.

Secure Future

By planning today, you can secure your future and manage your retirement income more effectively.

Three Simple Steps to Enroll

Get Started

Watch for an email from John Hancock and use the link to enroll.

1

Apply Online

Apply for this voluntary benefit that includes life insurance plus long-term care coverage.

2

Wait for Approval

You will receive a decision from John Hancock on this voluntary benefit.

3

Frequently Asked Questions

Can’t find what you are looking for? Contact Hunter Ewing at hewing@highgroundcompany.com

Meet with a specialist

What is Premier Benefit IUL?

Premier Benefit IUL is a permanent indexed universal life insurance policy that provides death benefit, long-term care benefit, and the potential to build cash value over time. The policy offers flexible premium payments and allocation options between an indexed account tied to S&P 500 performance and a fixed account.

Who is eligible for this benefit?

- Employees actively at work, full-time (working at least 30 hours per week, 4 days per week).

- Only those employees with base salary $75,000 and over are eligible.

- Only those employees who are US citizens or reside full-time in the US are eligible.

How much does this plan cost?

The premium is based on a number of factors:

- How much death benefit you select.

- Your chosen premium allocation between the fixed and indexed accounts.

- The age that you are at the time of application.

- Your smoking status.

- Your underwriting status based on your answers to health questions.

Additional medical underwriting review may be required based on your answers to the health questions.

The best way to see your pricing is to click "Build Your Benefit" for an estimate and then "Enroll Today" to begin the enrollment process for pricing specific to you. You are under no obligation to purchase once you start the enrollment process and can exit anytime.

You will enter some personal information and choose a death benefit from 1x, 3x, and 5x your salary, up to a maximum death benefit of $500,000.

How does this program cover LTC costs?

This program is a Term Life Insurance Policy with Long Term Care (LTC) Rider Benefits. It provides dual protection for the cost of LTC and financial support for your beneficiaries after you are gone.

When you elect a life insurance benefit amount, you will also get LTC coverage. The LTC coverage amount that you may access is a percentage of the Life Insurance benefit amount and is paid out in monthly increments.

Any LTC coverage used comes directly from the death benefit proceeds, dollar-for-dollar.

Can you explain in more detail how I might use the policy?

There are generally two ways you might use the policy:

If you need LTC coverage, the benefit will pay a monthly benefit of 4% of the total amount of Life Insurance you buy once you qualify for benefits. For example, if you buy $100,000 in Life Insurance coverage, you will receive $4,000 a month for up to 25 months (about 2 years).

If you don't need LTC in your lifetime, there is still a death benefit available to your beneficiaries. Again, using the example, if you buy $100,000 of life insurance and don't use any LTC expenses, your beneficiaries would still be able to receive up to $100,000 in death benefits.

Is there cash value in this policy?

Yes. Here's how the cash value works:

- Cash value can grow through premium payments and interest credits

- Growth is tax-deferred

- Two account options: Indexed Account (tied to S&P 500) and Fixed Account (guaranteed minimum 1% interest)

What are my Account options for policy growth?

- You may choose to allocate your premiums flexibly between the Fixed Index and the S&P Index.

- The Fixed Account has an emphasis on on stability, with a guaranteed minimum 1% interest rate.

- The Indexed Account is tied to the S&P 500, with an emphasis on potential growth.

- The choice should be made based on your risk tolerance and financial goals.

What is long term care (LTC)?

Long term care is the personal care and/or supervision (custodial, supervisory, or skilled care) needed by persons of all ages for an extended period.

Often this is because of conditions associated with the effects of aging, but LTC may be needed at any time due to an accident or illness. At some point in our lives, it is estimated that more than 60 percent of us will need assistance with things like getting dressed, driving to appointments, or making meals.

Is LTC covered by health or disability insurance?

It is a common misconception that LTC is covered by health or disability insurance. LTC services are typically not covered by Medicare, Medicaid, private health or disability insurance.

- Medicare: Only pays for skilled services or rehabilitative care for a limited time.

- Medicaid: Pays for the largest share of LTC services but has strict income and eligibility requirements.

- Employer / Private Health Insurance: Typically covers the same limited services as Medicare.

- Disability Insurance: Covers lost income for protection during working years but does not cover the cost of LTC services.

Should I consider this if I already have LTC insurance?

If you already have LTC insurance, great! You may want to use this enrollment as an opportunity to review your coverage. It is often recommended to keep your original coverage because of the value it provides. However, if you would like to review your existing plan in more detail, you can meet with one of the LTC insurance specialists supporting this enrollment to review your coverage and options.

Are there any limitations on where care is received?

If you qualify for LTC benefits, where you receive care is up to you (at home, assisted living, adult day care, nursing home). However, the policy will only pay LTC benefits for care received in the United States.

Death benefits are paid anywhere in the world.

What if I leave the company or retire?

This policy is completely portable – meaning you take the coverage with you even when you retire as long as you continue to pay the premiums.

How do I pay my premium?

During the application process, you will select from various premium payment options, including:

- Annual pay via direct bill.

- Semi-annual pay via direct bill.

- Monthly pay via automatic bank withdrawal.

Are my LTC or Life Insurance benefits taxable?

Life and LTCi benefits paid are generally received tax-free. However, as with all tax matters, you should consult your personal tax advisor to assess the impact of this benefit. The insurance company has no responsibility for any tax consequences of any benefits paid under this policy. The LTC rider is filed to be a federally tax-qualified LTC insurance contract.

What is the Vitality PLUS Program?

Vitality PLUS is an optional wellness program for policyholders that allow you to earn points for engaging in healthy activities, including, but not limited to

- Walking.

- Getting adequate sleep.

- Engaging in health check-ups.

- Buying healthy foods.

- Other healthy lifestyle activities.

Engaging in these activities earn you points, which can allow you to achieve various status levels: bronze, silver, gold, or platinum.

Rewards for achieving certain status levels include premium savings, apple watch deals, travel discounts, and much more.

For more information on the Vitality PLUS program, refer to this brochure: https://23149698.fs1.hubspotusercontent-na1.net/hubfs/23149698/Vitality%20program%20overview%20consumer%20brochure.pdf

Who is BuddyIns?

BuddyIns collaborates with benefit brokers, insurance companies, and financial professionals to provide employees and association members with the long term care education and enrollment processes they need to make the best decision for their futures.

About John Hancock

John Hancock has been a leader in the insurance industry for over 160 years.

This experience in providing insurance solutions that fit their clients' financial picture is a very important reason that they were chosen to offer this benefit to Thompson Thrift employees.

Another important item about John Hancock is their financial strength. With an A+ A.M. Best financial rating, they have the stability required to keep their promises, pay their claims, and always be there for their clients.

Learn more about John Hancock at https://www.johnhancock.com/

BuddyIns is an insurance producer and insurance enrollment education and technology company that has teamed up with Highground to bring this opportunity to qualifying employees. The information provided here is an overview of the referenced product and is not intended to be a complete description of all terms, conditions, and exclusions. Not available in all states. Eligibility, available coverage limits, and discounts vary and are subject to carrier underwriting. All trademarks used herein are the property of their respective owners in the United States and abroad.

BuddyIns Insurance Services | 4047 Meadow Lark Drive, Calabasas, CA 91302. CA Lic. #0M72219, 6000880

Get notified on new marketing insights

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.

.png)