Purchase coverage with guaranteed approval. Eligible members cannot be turned down during this enrollment period.

What's Special About This Offer

Guaranteed Issue

Portable Benefit

Take the coverage with you if you move to another state or leave the association.

Spousal Coverage

Extend your coverage options to include your spouse, ensuring they are protected.

Affordable Rates

Affordable rates with guaranteed level life insurance premium - a great value!

How does it work?

CALCULATE YOUR LTCI COST vs. BENEFIT

Disclaimer: This sample is intended to help inform and educate and shows example rates and potential benefits for the selected conditions. Please refer to the enrollment system for final rates and underwriting eligibility. This is not an offer of coverage.

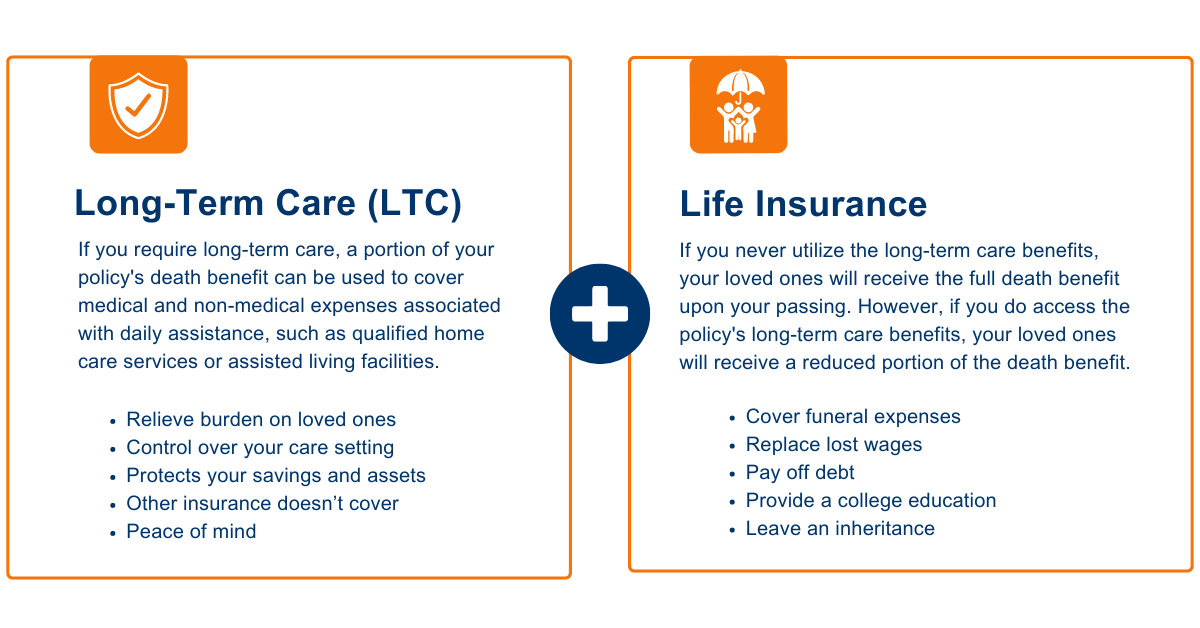

1. Access Long Term Care and Life Insurance Benefits

Receive 4% per month as a reduction of your initial Life Insurance coverage over 25 months. Then get an additional 4% per month for another 25 months of LTC coverage for a total of 50 months. This means you can receive up to 2 times your Life Insurance amount for your LTC benefit.

2. Make The Most of Your Life Insurance

Don't need long term care during your lifetime? The death benefit is still available to your beneficiaries. While the policy is in force, the death benefit is guaranteed for the longer of 25 years or through age 70.

Two Solutions In One

If you use your entire death benefit, the Restoration of Death Benefit Rider restores the life coverage to 50% of the original death benefit up to a maximum of $50,000 on which the LTC benefits were based, therefore assuring a death benefit up to the insured's age of 121

Lock in your rates! Pricing is based on your age.

The longer you wait to purchase coverage, the more it will cost you.

Get notified on new marketing insights

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.