LifeTime Benefit Term

Welcome CDA Members! We're excited to offer life insurance with a long term care (LTC) benefit. This guaranteed issue Chubb LifeTime Benefit Term policy with a long term care benefit, can protect your family from the financial impact of your extended care.

LTC 101: Understand the Long Term Care Challenge

Impact

53 million people in the United States are providing unpaid care for a loved one.

COST

The national average cost for an in-home health aide is $6,292 a month.

Funding

Medicare, health insurance, or disability insurance do not cover LTC expenses.

Why do you need long term care insurance?

Long term care (LTC) may become necessary following a traumatic event, such as a motorcycle accident, or due to a serious illness or cognitive impairment, such as Alzheimer's disease. In these situations, individuals may require ongoing assistance with ADLs to maintain their quality of life and independence to the greatest extent possible.

How does it work?

Available to members who are also working at least 17.5 hours per week, Chubb LifeTime Benefit Term with a long term care benefit is a two-in-one benefit that offers guaranteed issue life insurance up to age 70 for family needs plus long term care benefits.

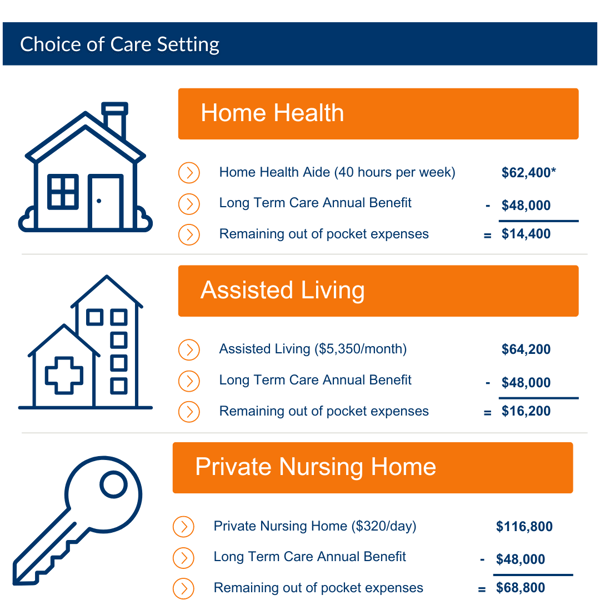

Here are examples of how LifeTime Benefit Term can provide a monthly long term care benefit of $4,000/month with these care costs reflecting the national median.

Also, don't forget to factor in the future cost of care average increase of 4% or more annually, which is why we encourage those who can afford it to purchase up to $6,000/month of LTC benefits.

Doesn't My Other Insurance Cover LTC Expenses?

The short answer is no. It is a common misconception that LTC is covered by health or disability insurance.

🚫NO COVERAGE

Health insurance typically does not cover long-term care. Long term care insurance is a separate policy designed to cover the costs of services like home health care and assisted living. It is not part of private medical insurance benefits so expenses associated with long term care are not covered by health insurance plans.

🚫NO COVERAGE

This type of insurance is designed to protect your income in the event you are unable to work due to a disability or illness. It typically covers a portion of your income and helps you manage your regular expenses, such as mortgage, bills, and groceries. Disability insurance was not designed to cover LTC services and excludes most LTC expenses

🚫NO COVERAGE

Medicare only covers up to 100 days of care after a 3 day stay in the hospital. According to the US Department of Health and Human Services, the average LTC claim is 3 years.

⚠️MINIMAL COVERAGE

Medicaid pays for the largest share of LTC services but has strict income and eligibility requirements you must meet to receive long term care services. Medicaid usually provides services in a nursing home unless you get approved for a special waiver. For Medicaid to even cover long term care, you must first spend down whatever assets you have. Medicaid is for those who truly don’t have any money to cover long term care expenses

Lock in your rates! Pricing is based on your age.

The longer you wait to purchase coverage, the more it will cost you. Guaranteed issue available up to age 70.

Explore More Benefits

Chubb Critical illness and Chubb Accident Insurance offers coverage for expenses not covered by traditional health insurance.

.png?width=764&height=175&name=Enrollment%20Page%20Graphic1%20(3).png)

BuddyIns is an insurance producer and insurance enrollment education and technology company that has teamed up with TDIC Insurance Solutions to bring this opportunity to qualifying CDA members. The information provided here is an overview of the referenced product and is not intended to be a complete description of all terms, conditions, and exclusions. Not available in all states. Eligibility, available coverage limits, and discounts vary and are subject to carrier underwriting. All trademarks used herein are the property of their respective owners in the United States and abroad. TDIC Insurance Solutions, CA Lic. #0652783.

BuddyIns Insurance Services | 4047 Meadow Lark Drive, Calabasas, CA 91302. CA Lic. #0M72219, 6000880

Get notified on new marketing insights

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.